So you want to register a business in Kenya. Smart move.

But here’s the reality: most people overthink this process, waste weeks going in circles, or pay middlemen ridiculous fees to do something they could handle themselves in a few hours.

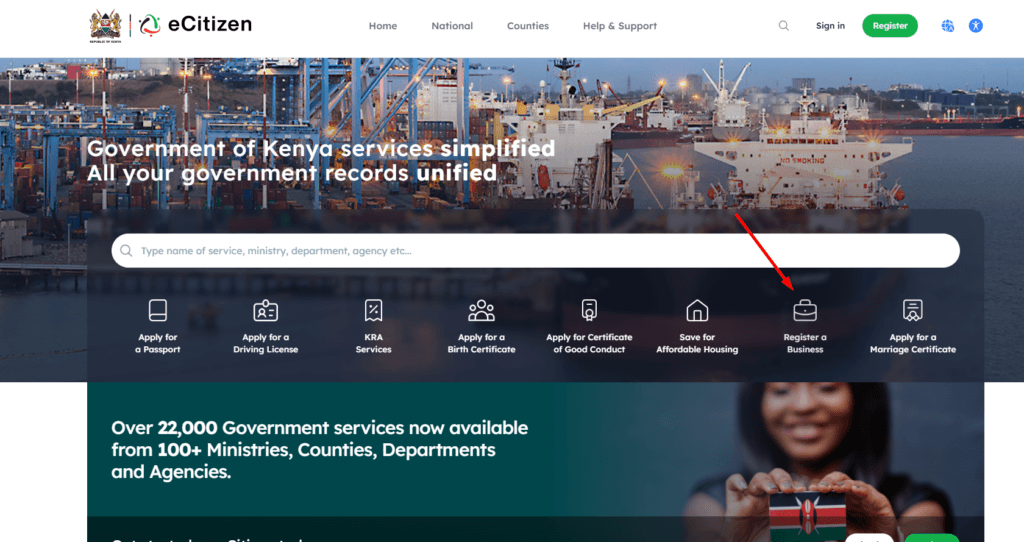

I’m going to break down exactly how to register a business in Kenya, whether you’re doing it online through eCitizen or offline at Huduma Centre.

Get the exact steps, costs, and timelines you need to get your business legally registered and operational.

By the end of this guide, you’ll know the difference between a business name, sole proprietorship, and limited company. You’ll understand the requirements, avoid common mistakes, and most importantly, you’ll be ready to take action today.

Let’s get into it.

TL;DR: How to Register a Business in Kenya

Business registration in Kenya takes 1-7 days and costs between KES 1,950 and KES 11,050 depending on your business structure.

Here’s the breakdown:

- Business Name Registration: KES 1,950 (sole proprietorship or partnership). Done online via eCitizen in 1-3 days.

- Limited Company Registration: KES 10,050 to KES 11,050. Takes 3-7 days through the Business Registration Service (BRS) portal.

- Requirements: National ID or passport, KRA PIN, valid email, and physical business address.

- Process: Register on eCitizen, search for name availability, submit application, pay fees, download certificate.

The online process through eCitizen business registration is faster and cheaper than going offline. After registration, you must register for KRA PIN (if you don’t have one) and file annual returns to stay compliant.

Business Structures in Kenya Explained

Before you start the business registration process, you need to choose your business structure.

This isn’t just paperwork.

Your choice affects your taxes, liability, and how you operate.

Three main options:

1. Sole Proprietorship

This is you operating as an individual. Simple, cheap, fast. You and the business are legally the same entity. If the business gets sued, you get sued. If it goes bankrupt, you go bankrupt. Cost: KES 1,950.

2. Partnership

Two or more people running a business together. Still simple, but now you’re sharing profits, losses, and liability. Same registration cost as sole proprietorship: KES 1,950.

3. Limited Company (Private Limited)

This is a separate legal entity. The company can own property, sue, and be sued independently of you.

Your personal assets are protected if things go south. This is what serious entrepreneurs choose when they’re building something that will scale. Cost: KES 10,050 to KES 11,050.

My take?

If you’re testing an idea or running a small side hustle, start with sole proprietorship. If you’re serious about building a real business, go straight to limited company registration.

Don’t waste time registering twice.

Kenya Business Registration Requirements

Here’s what you need before you start:

For All Business Types:

- Valid National ID or passport

- KRA PIN certificate (get this first if you don’t have it)

- Active email address

- Working phone number

- Physical business address (not a P.O. Box)

Additional Requirements for Limited Companies:

- At least one director (can be you)

- At least one shareholder (can also be you)

- Company secretary (required if turnover exceeds KES 5 million)

- Memorandum and Articles of Association (generated automatically online)

- CR12 form (directors’ details)

Cost Breakdown:

- Business name search: Free

- Business name registration: KES 1,950

- Company name reservation: KES 1,000

- Company registration: KES 10,050

- Certificate of incorporation: Included

- CR12 filing: KES 1,000 (if applicable)

Step by Step: How to Register a Business in Kenya Online

The online process through eCitizen is straightforward. Here’s exactly what to do.

Step 1: Create an eCitizen Account (15 minutes)

Go to ecitizen.go.ke. Click “Register a Business” and fill in your details. You’ll need your National ID number and a valid email. Verify your email, log in, and you’re ready to start.

Step 2: Business Name Search Kenya (10 minutes)

Before you can register anything, you need to confirm your business name is available. On the eCitizen dashboard, go to Business Registration Service (BRS). Select “Business Name Search.”

Pro tip: Have 3-5 name options ready. Your first choice might be taken. The search is free, so check multiple variations.

Search rules:

- Name must be unique

- Cannot be identical or too similar to existing registered names

- Cannot include restricted words like “government,” “national,” or “royal” without approval

- Should reflect your actual business activity

Step 3: Register Business Name (For Sole Proprietorship/Partnership)

Once you confirm your name is available, select “Business Name Registration” from the BRS menu.

Fill in the application form:

- Business name (exactly as searched)

- Business physical address

- Nature of business (be specific)

- Owner details (ID number, KRA PIN, email, phone)

For partnerships: You’ll need details of all partners, including their ID numbers and KRA PINs.

Upload required documents (scanned copies):

- National ID (both sides)

- KRA PIN certificate

Pay the registration fee of KES 1,950 using M-Pesa, credit card, or bank transfer.

Timeline: Your business name certificate will be ready for download in 1-3 days. Check your eCitizen account regularly.

Step 4: Register a Company in Kenya (For Limited Companies)

If you’re going the limited company route, the process has a few more steps.

Step 4A: Reserve Company Name (KES 1,000)

On BRS, select “Company Name Reservation.” Enter your preferred name and pay KES 1,000. You’ll get approval or rejection within 24 hours. Reserved names are valid for 30 days.

Step 4B: Complete Company Registration Form

After name approval, select “Company Registration.” You’ll fill in:

- Company name

- Registered office address

- Directors’ details (minimum one, maximum based on Articles)

- Shareholders and share distribution

- Company secretary details (if applicable)

- Business activity/objectives

The system auto-generates your Memorandum and Articles of Association based on standard templates. You can customize these if needed.

Step 4C: Submit Required Documents

Upload:

- Directors’ National IDs (all directors)

- Directors’ KRA PIN certificates

- Shareholders’ IDs and PINs

- Proof of registered office address (utility bill or lease agreement)

- CR12 form (directors’ particulars)

Step 4D: Pay Registration Fees

Total cost: KES 10,050 to KES 11,050 depending on your share capital and additional filings.

Timeline: You’ll receive your certificate of incorporation in 3-7 days. This is your proof that your company legally exists.

Offline Business Registration Process

Not everyone wants to do things online. Maybe you don’t have reliable internet, or you prefer face-to-face assistance. Here’s how to register a business offline.

Where to go: Any Huduma Centre or the Registrar of Companies office in Nairobi.

What to bring:

- Printed and filled application forms (get these at the office or download from BRS website)

- Original National ID and photocopies

- Original KRA PIN certificate and photocopy

- Passport photos (2 copies)

- Cash or bank draft for registration fees

The process:

- Go to the business registration counter

- Submit your documents and forms

- Pay fees at the cashier

- Get a receipt and application reference number

- Wait 7-14 days for processing

- Return to collect your certificate

Downsides of offline registration:

- Slower (7-14 days vs 1-7 days online)

- More expensive if you factor in transport and time

- Higher chance of errors requiring you to return multiple times

- Long queues at Huduma Centres

Unless you absolutely cannot access eCitizen, go online. It’s faster, cheaper, and you can track everything from your phone.

After Registration: Next Steps

Getting your certificate is just the beginning. Here’s what you must do next:

1. Register for KRA PIN (If You Don’t Have One)

Your business needs its own KRA PIN separate from your personal PIN (for limited companies). Go to iTax portal, create an account, and apply for a business PIN. This takes 1-3 days.

2. Apply for Business Permits

Depending on your industry and location, you’ll need:

- County business permit (from your county government)

- Single business permit (combines multiple licenses)

- Specialized licenses (health, liquor, professional practice, etc.)

3. Open a Business Bank Account

Take your registration certificate, KRA PIN, and National ID to any bank. Compare business account fees because they vary widely.

4. File Annual Returns

This is critical. Every registered business must file annual returns with the Registrar of Companies. Limited companies file within 42 days after their AGM. Business names file annually. Failure to file leads to penalties and potential deregistration.

5. Maintain Compliance

Keep proper books of account, file tax returns on time, and update the Registrar of Companies of any changes (directors, address, shareholding).

Common Mistakes to Avoid

Not checking name availability thoroughly. Just because a name doesn’t appear in search doesn’t mean it’s automatically approved, especially if it’s too similar to existing names.

Using P.O. Box as business address. The Registrar of Companies requires a physical address. Use your actual location.

Forgetting to file annual returns. This is the number one reason businesses get struck off the register. Set calendar reminders.

Mixing personal and business finances. Open that separate bank account immediately. Your future accountant will thank you.

Not understanding your tax obligations. Register for the right tax types on iTax based on your business activity (VAT, PAYE, withholding tax, etc.).

Cost of Registering a Business in Kenya (Final Breakdown)

Business Name (Sole Proprietorship/Partnership):

- Registration: KES 1,950

- Total: KES 1,950

Limited Company:

- Name reservation: KES 1,000

- Company registration: KES 10,050

- CR12 filing: KES 1,000 (if needed)

- Total: KES 11,050 to KES 12,050

Additional Costs (After Registration):

- Business permit: KES 5,000 to KES 30,000+ (varies by county and business type)

- KRA PIN: Free

- Bank account opening: KES 0 to KES 5,000 (depends on bank)

- Professional services (optional): KES 10,000 to KES 50,000

Budget at least KES 20,000 to KES 50,000 total to get fully operational with permits and bank accounts.

Take Action Now

Here’s your action plan:

Today: Create your eCitizen account and do a business name search. This takes 25 minutes total.

Tomorrow: Gather your documents (ID, KRA PIN, address proof). If you don’t have KRA PIN, apply for it now.

Day 3: Submit your registration application and pay fees.

Day 4-7: Monitor your eCitizen account for your certificate. Download it immediately when ready.

Week 2: Apply for county business permit and open business bank account.

Week 3: Register for additional tax obligations on iTax portal.

Business registration in Kenya is not complicated. It’s systematic. Follow these steps, don’t overthink it, and you’ll be legally registered and operational within two weeks.

Stop researching. Stop planning. Go register your business today. The market doesn’t reward perfect plans. It rewards those who execute.

Read also: