Listen. Starting a business in Kenya isn’t rocket science, but most people make it harder than it needs to be. They overthink it, delay it, or worse, they skip crucial steps and end up paying for it later with penalties, shutdowns, or legal headaches.

Here’s the truth: Kenya has one of the most streamlined business registration systems in Africa.

Thanks to eCitizen Kenya and the Business Registration Service (BRS), you can register your business from your phone while sitting in traffic on Thika Road.

No queues. No bribes. No running around government offices.

But you need to know the exact steps, the real costs, and what the Kenya Revenue Authority (KRA) actually requires.

That’s what this guide delivers.

This is what works in 2026.

TL;DR: How to Start a Business in Kenya

Here’s how to start a business in Kenya in 5 core steps:

- Choose your structure (sole proprietorship, partnership, or limited company)

- Register on eCitizen and reserve your business name through BRS (KES 950 for sole proprietorship, KES 10,650+ for companies)

- Get your KRA PIN for the business entity (free, online via iTax)

- Apply for your Single Business Permit from your county government (KES 4,000-100,000+ depending on size and location)

- Open a business bank account and start operations

Timeline: 3-7 days for sole proprietorships, 7-14 days for limited companies.

Total startup costs: KES 15,000-150,000+ depending on your business structure and county.

Now let’s break down exactly how each step works.

Step 1: Choose the Right Business Structure (This Matters More Than You Think)

Most people skip this step and regret it later. Your business structure determines your liability, taxes, and how fast you can scale. Here are your main options when you start a business in Kenya:

Sole Proprietorship

- Best for: Solo hustlers, freelancers, small traders, service providers

- Cost: KES 950 total (name search merged with registration in 2025)

- Timeline: 1-3 days

What you need to know:

- You and your business are the same legal entity

- Unlimited liability (your personal assets are at risk if the business fails)

- Simplest tax filing

- Perfect if you’re testing an idea or running a side hustle

This is where 90% of Kenyan entrepreneurs should start. It’s cheap, fast, and you can always convert to a company later when you’re making serious money.

Partnership

- Best for: Two or more people going into business together

- Cost: KES 950 (same as sole proprietorship)

- Timeline: 3-5 days

What you need to know:

- Liability is shared between partners

- Get a partnership agreement in writing (seriously, do this)

- Each partner files their own tax returns

Private Limited Company (LLC)

- Best for: Businesses planning to raise capital, hire employees, or scale regionally

- Cost: KES 10,650+ (government fees only, add KES 25,000-40,000 for professional services)

- Timeline: 7-14 days

What you need to know:

- Limited liability (your personal assets are protected)

- Requires at least one shareholder and one director (one must be Kenyan)

- More complex tax filing and annual returns

- Opens doors to government tenders and serious investors

- 30% corporate tax rate applies

When to choose an LLC: If you’re planning to hire employees, work with big corporates, or scale beyond Kenya’s borders, start with an LLC. The upfront cost is higher, but you’ll save yourself the headache of converting later.

Step 2: Register Your Business on eCitizen (The Actual Process)

Business registration in Kenya happens 100% online through the eCitizen portal. Here’s the exact process:

For Sole Proprietorship/Partnership:

A. Create Your eCitizen Account

- Go to ecitizen.go.ke

- Register using your ID number (Kenyans) or passport (foreigners)

- Verify your email

B. Access Business Registration Service (BRS)

- Log into eCitizen

- Navigate to Business Registration Service

- Click “Make Application”

C. Submit Your Business Names

- Provide 3-5 business name options in order of preference

- The Registrar approves the first available name within 1-2 days

- Pro tip: Have backups ready. Names that are too similar to existing businesses get rejected

D. Fill Out the Registration Form

- Business activity description

- Physical address (county, street, building, plot number)

- Postal address

- Contact information

- Upload required documents:

- Copy of your National ID/Passport

- KRA PIN Certificate

- Recent passport photo

E. Pay the Registration Fee

- Pay KES 950 via M-Pesa, card, or bank transfer

- Get your acknowledgment receipt

F. Download Your Certificate

- Processing takes 3-5 working days

- You’ll receive your Business Registration Certificate with your unique Business Registration Number

For Limited Companies:

The process is similar but requires additional information:

- Memorandum and Articles of Association

- Details of all directors and shareholders

- Share capital structure

- Company secretary details (if applicable)

- At least one director must be Kenyan or a resident

Cost breakdown for companies:

- Name search and reservation: Built into registration fee

- Company registration: KES 10,650 (for companies with share capital under KES 1 million)

- Stamp duty: 1% of nominal share capital

- Professional fees (optional but recommended): KES 25,000-40,000

Read also; How to Register a Business in Kenya 2026(Online & Offline Process).

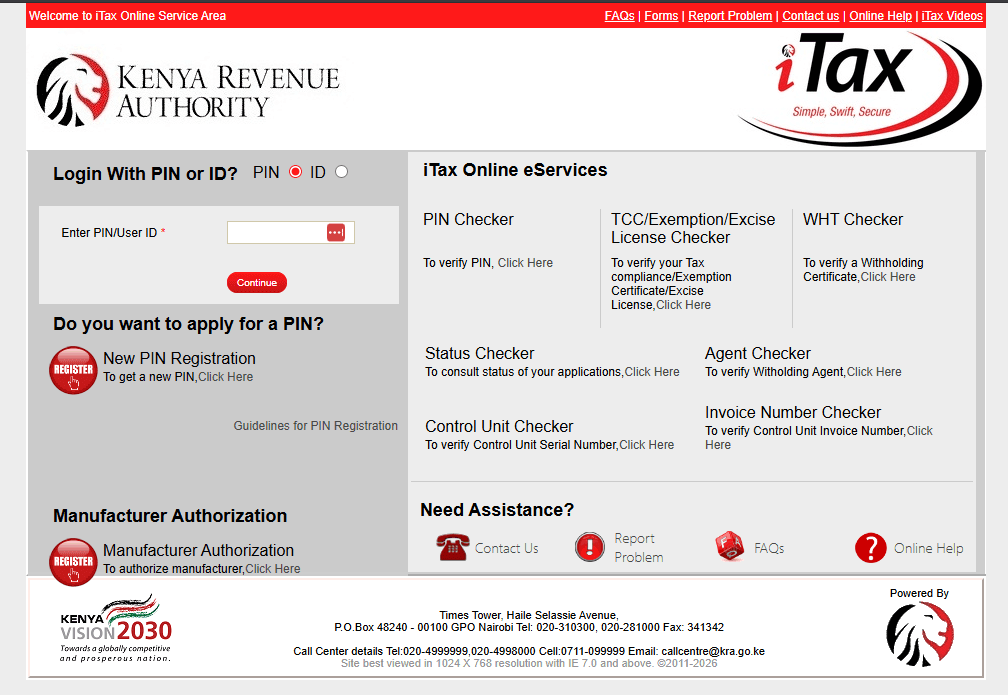

Step 3: Get Your KRA PIN (Non-Negotiable)

Every business in Kenya needs a KRA PIN registration. This is your tax identification number, and you can’t operate legally without it.

For Sole Proprietors:

You’ll use your personal KRA PIN initially, but it’s smart to register a separate business KRA PIN for cleaner accounting.

For Companies:

This is mandatory. Here’s how:

A. Access KRA iTax Portal

- Go to itax.kra.go.ke

- Register if you don’t have an account

B. Start PIN Registration

- Click “New PIN Registration”

- Select “Company/Organization”

- Choose “Online Form”

C. Submit Required Documents

- Certificate of Incorporation

- CR12 (company ownership extract from Registrar of Companies)

- Director’s ID and KRA PIN

- Memorandum and Articles of Association

- Physical and postal addresses

D. Wait for Approval

- Timeline: 5-7 business days

- KRA sends your PIN certificate via email

- Download and print it

Cost: FREE (KRA doesn’t charge for PIN registration)

Important: You need this PIN to open a business bank account, apply for permits, and file tax returns. Don’t skip it.

Step 4: Apply for Your Single Business Permit

The Single Business Permit from your county government is what actually allows you to operate.

Requirements to start a business in Kenya include this permit, which replaced the old multiple license system.

Cost of Starting a Business in Kenya (Permit Fees):

Costs vary widely by county and business size:

Nairobi County (2025 rates):

- Small traders (under 5 employees): KES 4,000/year

- Medium traders (5-20 employees): KES 10,000/year

- Large traders (21-50 employees): KES 20,000/year

- Transport companies (over 100sqm): KES 100,000/year

Other counties:

- Small businesses (rural areas): KES 5,000-20,000/year

- Medium businesses: KES 20,000-50,000/year

- Large enterprises: KES 50,000-200,000/year

How to Apply:

For Nairobi:

- Use Nairobi Services Portal (nairobiservices.go.ke) or USSD *647#

- Submit business registration certificate, KRA PIN, proof of premises

For other counties:

- Visit county government offices or Huduma Centres

- Some counties have online portals

Timeline: 7-14 working days

Pro tip: Some businesses need additional sector-specific licenses:

- Food businesses: Health permit

- Manufacturing: NEMA license, Fire safety certificate

- Healthcare: Pharmacy Board permit

- Transport: NTSA licenses

Step 5: Open a Business Bank Account

Banks require:

- Certificate of Incorporation/Business Registration

- KRA PIN certificate

- Memorandum and Articles of Association (for companies)

- Board resolution authorizing account opening (for companies)

- National ID of directors/proprietors

Why this matters: A business bank account separates your personal and business finances, making tax filing easier and building your business credit profile.

Step 6: Register for Statutory Deductions (If You Have Employees)

Once you start hiring, register for:

NSSF (National Social Security Fund)

- Mandatory for all employers

- Register at NSSF offices or online

- Contribute based on employee salaries

NHIF (National Hospital Insurance Fund)(Now SHA)

- Required for employee health insurance

- Register at NHIF offices or online

- Monthly contributions based on salary brackets

PAYE (Pay As You Earn)

- Register on KRA iTax portal

- Deduct and remit employee income tax monthly

- File returns by the 9th of every month

Step 7: Stay Compliant (The Part Most People Ignore)

Starting is one thing. Staying legal is another. Here’s what you must do:

For All Businesses:

- File annual income tax returns with KRA (deadline: June 30)

- Renew your business permit annually

- Keep proper books and records (minimum 5 years)

For VAT-Registered Businesses:

- If your turnover exceeds KES 5 million annually, register for VAT (16%)

- File monthly VAT returns

- Issue VAT-compliant invoices

For Limited Companies:

- File annual returns with the Registrar of Companies (costs KES 1,000-5,000)

- Pay 30% corporate tax on profits

- Hold Annual General Meetings and keep minutes

Costs Breakdown: How Much to Start a Business in Kenya

Let’s talk actual numbers because this is what you’re really wondering:

Sole Proprietorship (Minimum Viable Business):

- Business name registration: KES 950

- County business permit: KES 4,000-10,000

- KRA PIN: Free

- Business bank account opening: KES 0-5,000

- Total: KES 5,000-16,000

Private Limited Company (Growth-Focused):

- Company registration: KES 10,650

- Professional services (optional): KES 25,000-40,000

- Stamp duty (1% of share capital): Varies

- County business permit: KES 10,000-50,000

- Business bank account: KES 0-10,000

- Total: KES 45,000-120,000+

Add These If Needed:

- Office space/rent: KES 10,000-100,000/month

- Initial inventory: Varies by business

- Marketing budget: KES 20,000-100,000

- Website/online presence: KES 10,000-50,000

Timeline: How Long Does It Actually Take?

Sole Proprietorship:

- Day 1-2: Name approval

- Day 3-5: Certificate issued

- Day 6-10: KRA PIN (if needed)

- Day 11-25: Business permit

- Total: 2-4 weeks to be fully operational

Limited Company:

- Day 1-2: Name approval

- Day 3-14: Certificate of Incorporation

- Day 15-21: KRA PIN

- Day 22-35: Business permit

- Total: 5-6 weeks to be fully operational

Common Mistakes That Cost Money

- Using a name too similar to an existing business – Gets rejected, wastes time

- Skipping the business permit – County officers will shut you down, plus penalties

- Not separating personal and business finances – Tax nightmare during filing

- Starting as a company when a sole proprietorship would work – Unnecessary costs and complexity

- Forgetting annual returns – Late fees and compliance issues

Who Needs to Start a Business in Kenya?

You should register if you’re:

- Earning income from trade or services

- Hiring employees

- Applying for government tenders

- Opening business bank accounts

- Invoicing clients professionally

- Planning to scale beyond side hustle

Real talk: If you’re making over KES 50,000/month, stop operating informally. Register properly. The risk of penalties and lost opportunities isn’t worth the “savings.”

Tools and Resources You Need

Official Portals:

- eCitizen: ecitizen.go.ke (business registration)

- KRA iTax: itax.kra.go.ke (tax registration and filing)

- BRS: brs.go.ke (Business Registration Service)

- Nairobi Services: nairobiservices.go.ke (Nairobi permits)

Support Centers:

- Huduma Centres across Kenya (walk-in support)

- KRA offices (tax guidance)

- County government offices (permits and licenses)

Final Word: Just Start

Here’s the thing about how to register a business name in Kenya: the system is easier than ever in 2026. The eCitizen business registration portal works. The costs are transparent.

The timelines are predictable.

Most people overthink this. They spend months “planning” when they could have launched in two weeks.

Yes, you need to follow the legal requirements. Yes, you need the right permits. But none of this should paralyze you.

Pick your structure (start with sole proprietorship if you’re unsure). Register on eCitizen. Get your KRA PIN. Apply for your permit. Open your account. Then focus on making money.

The business won’t build itself while you’re researching the “perfect” way to register.

Take action today. Your future self will thank you.

Next Steps:

- Head to ecitizen.go.ke right now

- Create your account

- Start the business name registration process

- Have your ID and KRA PIN ready

- Submit your application

That’s it. You’ve got this.

Disclaimer: Fees and regulations may change. Always verify current rates on official government portals before making payments. This guide reflects regulations as of December 2025.